£80,000 Returned to 71-Year-Old Retiree in Investment/Recovery Scam

In 2020 Mr Jones – a retired lorry driver, aged 71 – was targeted by scammers claiming to represent an investment company that could help

Garnet Ross understand the devastating impact a fraud or scam can have on its victims. Firstly, there is an immediate financial loss when money, often large sums of cash or cryptocurrency, is lost to scammers. Secondly, and perhaps most importantly, is the emotional impact, when people realise they’ve been duped, many of whom feel embarrassed or ashamed about what’s happened. However, if you’ve fallen prey to a financial or crypto scam you are not alone. According to UK Finance, hundreds of millions of pounds worth of authorised payments are transferred to scammers every year in the UK. There has been a substantial increase in scams in recent years, with the trade association for the UK banking and financial services sector describing it as ‘a national security threat’. However, if you’re among those people who’ve suffered as a result of a fraud or scam, then there are steps we can take to recover your money.

Garnet Ross has a dedicated team of solicitors who specialise in helping victims of fraud or scams. We provide national coverage, helping UK-based individuals and businesses, recover money or assets lost to fraudsters/scammers. We are experienced in dealing with: purchase scams; impersonation scams; investment scams; crypto scams; romance scams; advance fee scams; invoice scams and corporate scams. Our approach is simple but effective, using proven techniques and the latest technology, we help victims of fraud recover all of their lost funds.

We have an experienced financial mis-selling team that will initially investigate all of the financial transactions in relation to the fraud. If we believe any financial rules, regulations, codes of conduct, laws and internal policies have been breached then we will complain to the financial institution and seek redress. This is always our first point to help you recover lost funds as it can allow quick redress. To assist us in this we have state-of-the-art software, developed by our subsidiary company Lawtec.ai, that allows us to quickly review financial statements and documents to identify relevant transactions and patterns of financial behaviour in order to quickly identify your losses and calculate your claim. By complaining to financial institutions such as banks, investment advisors, and cryptocurrency exchanges we also get further details of the fraud that can allow us to broaden our investigations. We also have access to software that assists us in tracing money invested into cryptocurrency through the blockchain so we can identify wallets where defrauded cryptocurrencies are sitting.

Through a range of techniques, financial complaints and legal proceedings we can identify money lost and seek recovery through the banking system and other financial organisations. The system is set up to prevent fraud and often when Fraud has occurred, we can go after financial organisations that have let you down. We will always do this and will also seek to recover your lost money in other ways. If a scammer is identified and where necessary, we use specialist forensic accountants to help trace funds and we have a network of law firms worldwide that can assist recovery of monies hidden in offshore tax havens and foreign jurisdictions. If we identify the scammer, we can instruct agents to identify their assets to seek recovery from them. We also act for corporate clients in large frauds, where a perpetrator with assets can be identified, to freeze their assets and seek recovery through the courts. We can review the blockchain to trace crypto assets and if your stolen crypto assets are in a UK or EU-regulated exchange we can seek recovery of these assets. We can also provide our clients with expertise in:

If you’ve been targeted by sophisticated scammers, you will naturally be cautious when choosing a professional advisor. We would always encourage you to check the credentials of anyone who offers to help you get money back after a scam. Unfortunately, scammers are known to retarget their victims with offers of help, for an upfront fee, in an attempt to steal more money. We work on a no-win, no-fee basis so would never ask for money upfront. Put simply, if you win, we win. To reassure you that Garnet Ross is genuine, we’d like to share our company and regulatory information with you. Garnet Ross is a trading name of Cheshire Estate and Legal Limited (company number: 10370954). We are authorised and regulated by the Solicitors Regulation Authority (SRA number: 633955). The quickest way to check this is to click on the SRA badge at the bottom of this page. Regulated law firms must register their website with the SRA in order to display this clickable link, to validate they are genuine. If you would prefer to visit the SRA website directly, you can find us on their ‘Solicitors Register’. You can also visit the Law Society, which is the independent professional body for solicitors. Look us up on their website using their ‘Find a Solicitor’ tool. This is a free service for anyone looking for information about organisations or people providing legal services that are regulated by the SRA.

Investment scams

Investment scammers convince their victims they have a sound investment opportunity in order to get them to send them money. This could be a ‘brokerage firm’ that offers to help you trade in foreign exchange, binary options, cryptocurrency and other valuable commodities. These scammers often appear incredibly knowledgeable and have websites, testimonials and marketing materials to convince you that they are legitimate. Investment scammers are so sophisticated, they’ve been known to trick professional investors, so if this has happened to you then you should never be embarrassed to get in touch.

Impersonation scams

Impersonation scammers pose as well-known organisations in order to get their victims to send them money. They impersonate trusted organisations such as the police, banks, HMRC or well-known utility and service providers. They might tell you that there has been fraudulent activity on your account and that you should move your money to a ‘safe account’, that you have an unpaid bill that you must pay immediately or face legal consequences or that your account has been hacked and access is required to rectify the problem. Impersonation scammers are very convincing, so if this has happened to you please don’t hesitate to get in touch.

Romance scams

Romance scammers convince their victims they’re in a serious relationship in order to get them to send them money. They’ll typically pose as people living and working overseas, which is why they say they can’t meet in person. They don’t always ask for money straight away, instead spending a lot of time building up trust. Then, when they’ve established a good rapport, they’ll create an emergency and ask for temporary financial support. Romance scammers are very manipulative, so if this has happened to you then should never feel ashamed about what’s happened.

Purchase scams

Purchase scammers convince their victims to send them money for high-value items such as cars. In these scams, the goods won’t be received and the listing or seller will disappear after the bank transfer has been made. Purchase scammers know all of the tricks to deceive online shoppers, so if this has happened to you, you should never feel bad about getting in touch.

Yes, we have a team of financial recovery experts who specialise in getting back money lost to scammers. We will review all of the financial transactions in relation to the fraud and if we believe that more could have been done to protect you from fraud then we will complain to the relevant financial institution and seek redress. Where a scammer with assets can be identified, we can also pursue them through the courts.

Through a range of techniques, from financial complaints to legal proceedings, we can seek recovery from either the financial institution that should have detected and prevented the fraud to the scammer themselves, providing they have assets that we can seek recovery from. Where necessary, we use specialist forensic accountants to help trace funds and we have a network of law firms worldwide that can assist recovery of monies hidden in offshore tax havens and foreign jurisdictions.

You may believe that you were at fault for authorising the payment and, that as a result of this, there is nothing you can do. You may have also been put off by your bank if they’ve refused to refund your money. However, we’re experts in financial rules, regulations, codes of conduct, banking laws and legal processes that will assist in getting your money back from a scam. This is why our success rate is so high.

Yes. You can contact the relevant financial institution to try to recover the money yourself. You can also make a complaint if you’re not happy with the response you receive. However, if you would like us to do this for you, we will use our technical knowledge and legal expertise to give you the best chance of success. We’ll also be able to represent you in the event our advice is to pursue this through the courts.

Using Chainalysis Reactor software, our experts will attempt to trace cryptocurrency through the blockchain to an endpoint which is usually a crypto asset exchange provider.

No, we work on a ‘no-win, no-fee’ basis. If we are unsuccessful in recovering your money then you won’t pay us a penny. We also offer free initial, no-obligation advice so you have nothing to lose by getting in touch with one of our friendly advisors today. We can start working on your case as soon as you formally instruct us, and our paperwork has been signed. Additionally, you have a 14-day cooling-off period, after you’ve signed our initial documents if you change your mind.

In 2020 Mr Jones – a retired lorry driver, aged 71 – was targeted by scammers claiming to represent an investment company that could help

Details of this impersonation scam are also featured in The Daily Express and The Mirror. Garnet Ross successfully recovered £21,000 for 80-year-old widower who fell

his case study was previously featured on BBC’s Morning Live. Fraud is the most common crime in the UK, with billions lost each year. Advanced

In online investments, the promise of high returns can often be a strong indicator of fraudulent schemes. As usual, if it seems too good to

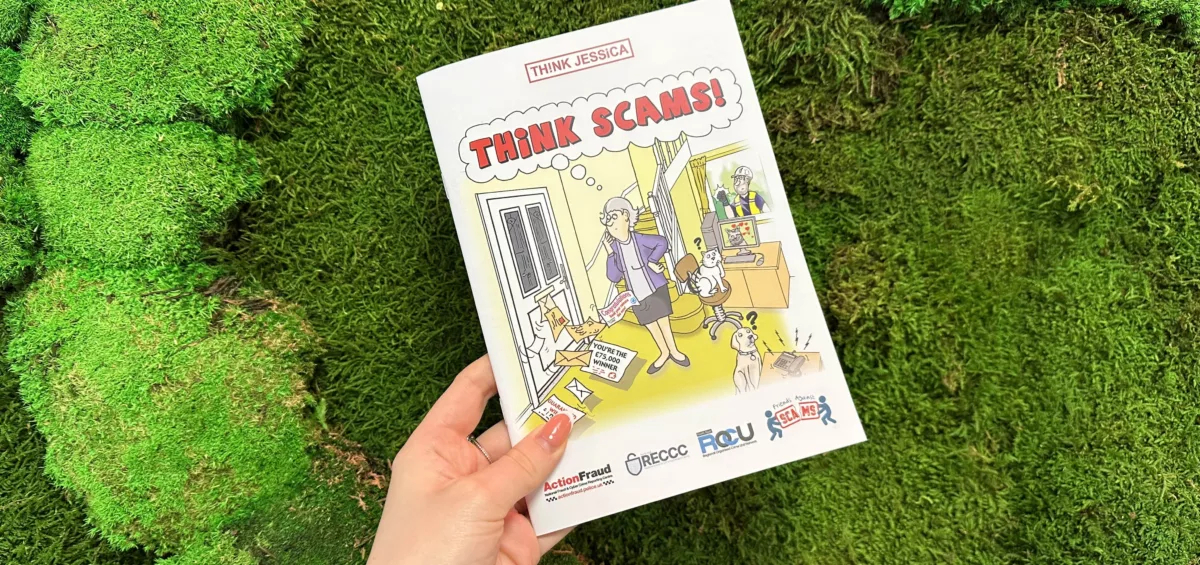

Garnet Ross has partnered with Think Jessica, a fraud publication which raises awareness of the dangers and financial implications of scams. What is Think Jessica?

In our technology-driven world, where innovation often comes with hidden dangers, it’s crucial to understand the growing threat of Artificial Intelligence (AI) scams. As legal

Canada : Toronto 222 Jarvis St, Toronto, ON M5B 2B8, Canada

United Kingdom : 30 Gresham St, London EC2V 7QP, United Kingdom

Dubai : 48 Burj Gate Towers - Sheikh Zayed Rd - Dubai - United Arab Emirates

Copyright © 2024 Garnet Ross | All rights reserved

Garnet Ross is a trading name of Cheshire Estate and Legal Limited, Company No: 10370971, registered in England & Wales. Registered Office: Lower Road, London SE16 2XB, United Kingdom. Authorised and regulated by the Solicitors Regulation Authority.